HDFC Bank, D NO 6-2-57Cinema Road,ADILABAD - 504001Telangana HDFC Bank, D.No.30-171, Ground Floor,Bunglow Rd, Nr_x000D_Īmbedkar StatueDist-Prakasham,ADDANKI - 523201 (AP) HDFC Bank, Opposite Khadi MandalNew Abbadi Jattan Mohalla,ADAMPUR 144102(Jalandhar) HDFC Bank, Vakil Lane,V.F.Basali,Nr Police Station,Dt- AmravatiParatwada,Achalpur-444805(MAH) HDFC Bank, Mewara Complex,Near Shanti Kunj Park,Mount RDABU_x000D_ IDBI Bank, Shree Sai Tower,Near Sai Baba Temple, Abu RoadSirohi-307026._x000D_ HDFC Bank, 1st Floor,Alkuber BuildingOpp BSNL exchangeABOHAR -_x000D_ IDBI Bank, Gaushala Road Near Bhadoo Filling StationNear LIC Building ,Abohar -_x000D_ Prakash (MSEB Office) Bhavan, Next to Bank of Baroda, Near Chattushringi Temple, above Tribes India, Senapati Bapat Rd, Shivajinagar, Pune, Maharashtra 411016, Ph: 9175937626 / 9175193456 Sanriya Investments, Kamdhenu, 2nd Floor, Opp. Search REC 54EC Capital Gain Bond Application Form submission centers in your city City/Location

(Find attached list below, Search for your city)ĩ] You need to carry properly filled application forms, submission centers do not provide application forms, only accept the forms and provide acknowledgement.ġ0] The Acknowledgement copy will suffice your taxation purpose.ġ1] Bond Certificate/ Letter of Allotment:- REC will issue the Bond Certificates within 2 months from the deemed dated of allotment or such extended period as may be decided by REC.ġ2] The actual bond will reflect in your demat account within 8-10 weeks’ time form date of allotment.ġ3] To track the status/allotment of your application form, send us the soft copy Application Form/ Acknowledgement Slip.ġ4] All application must have Broker Code: SSL-014 (SBI Cap Sec), Sub Broker Code: 7350200256.ġ5] Free* Home Service available in Pune*ġ6] Ask for service, not brokerage / commission / pass back / rebate, we don’t entertain people of this kind. 9175193456 / 9175937626 to check if something is missing or needs to be corrected.Ĩ] Or Submit / deposit your application form in Listed/ Design Bank Branches. 9175193456 / 9175937626.ħ] Before submitting your application, please send us an application image / soft copy / photocopy on whats app no. Prakash (MSEB Office) Bhavan, Next to Bank of Baroda, Near Chattushringi Temple, above Tribes India, Senapati Bapat Rd, Shivajinagar, Pune, Maharashtra 411016, Mob. Sanriya Investment Services, Kamdhenu, 2nd Floor, Opp.

Kgf kannada amc river east 21 download#

– Take print of the Application Form on A4 size paperĬlick here to download REC 54EC Capital Gain Bond Application form 2021-22Ĭlick here to find filled sample REC 54EC Capital Gain Bond Application Form to refer and avoid mistakesĪttach following document along with the downloaded application form : –ġ] PAN Card and Address Proof Photo Copy self-attested by applicant.Ģ] One Cancelled Cheque copy.(for ECS/RTGS/NEFT payment of Interest /Maturity Amount.)ģ] Cheque / DD should be drawn in favour of “REC Limited – 54 EC Bonds” or “Rural Electrification Corporation Ltd – 54EC Bonds”ĥ] Keep photocopy of application form for your record.Ħ] You can send your Application along with above document to below mention address:. No, cheque of your exiting bank account of any bank will work for investmentsĪpplication Process and Form Submission / Collection Centers “REC Limited -54 EC Bonds” or “Rural Electrification Corporation Limited – 54EC Bonds”ĭemat account is not mandatory, if you don’t have demat a/c, then you will receive physical bond certificate like your Fixed Deposit.ĭo I need to open new bank a/c from application accepting bank The Bonds are non-transferable, non-negotiable and cannot be Offered as a security for any loan or advanceīonds will be automatically redeemed by REC on maturity, without the surrender of Bond Certificate(s) and the proceeds would be paid by cheque or NECS/ECS.Ĭheque / Draft to be drawn in the name of Interest Taxable, Income Tax Act 1961 and TDS will not be deducted. 10,000/- each in a financial year (Subject to section 54EC of Income Tax Act, 1961)

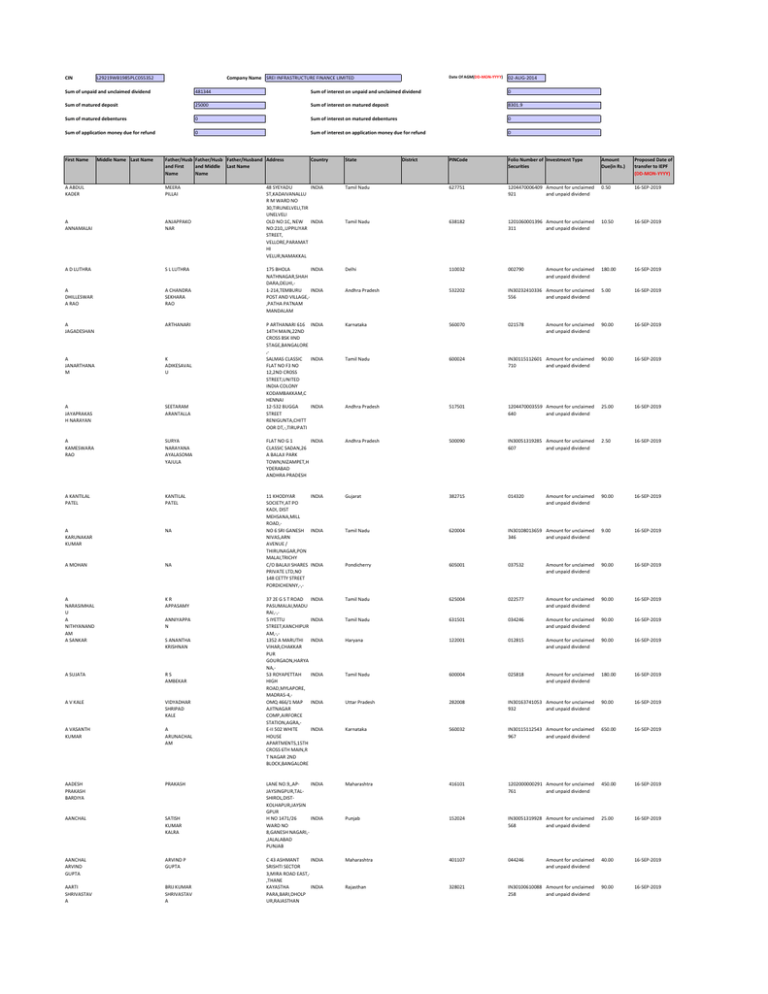

‘CRISIL AAA Stable’ by CRISIL, ‘CARE AAA’ by CARE, ‘IND AAA’ by India Ratings & Research Private Ltd, ICRA AAA’ by ICRA Limitedįace Value / Issue Price/ Minimum Investment Last day of each month for application money cleared and credited in REC’s collection account Rural Electrification Corporation Ltd REC 54 EC Capital Gains Bondsĥ% p.a, payable annually on 30th June of each year, Interest payment will be made by NECS/At Par Cheque/Demand DraftsĪt the prevailing Coupon Rate from the date of realization of cheque / demand draft / NEFT / RTGS. Under Section 54EC Tax Exemption Bonds Series-XV Type Rural Electrification Corporation Limited-REC Capital Gain Bond 2021-22

0 kommentar(er)

0 kommentar(er)